Feature Toggles allow Wellzesta Life to serve the aging-in-place market.

Aging-in-place

What is aging-in-place? There is an often-quoted AARP statistic that roughly 85 percent of people age 65 and older say they want to remain in their current home as they grow older. Put another way,

85% of seniors want to age-in-place.

A second statistic that gets a lot of attention is:

By 2030, 1 in 5 Americans will be age 65+.

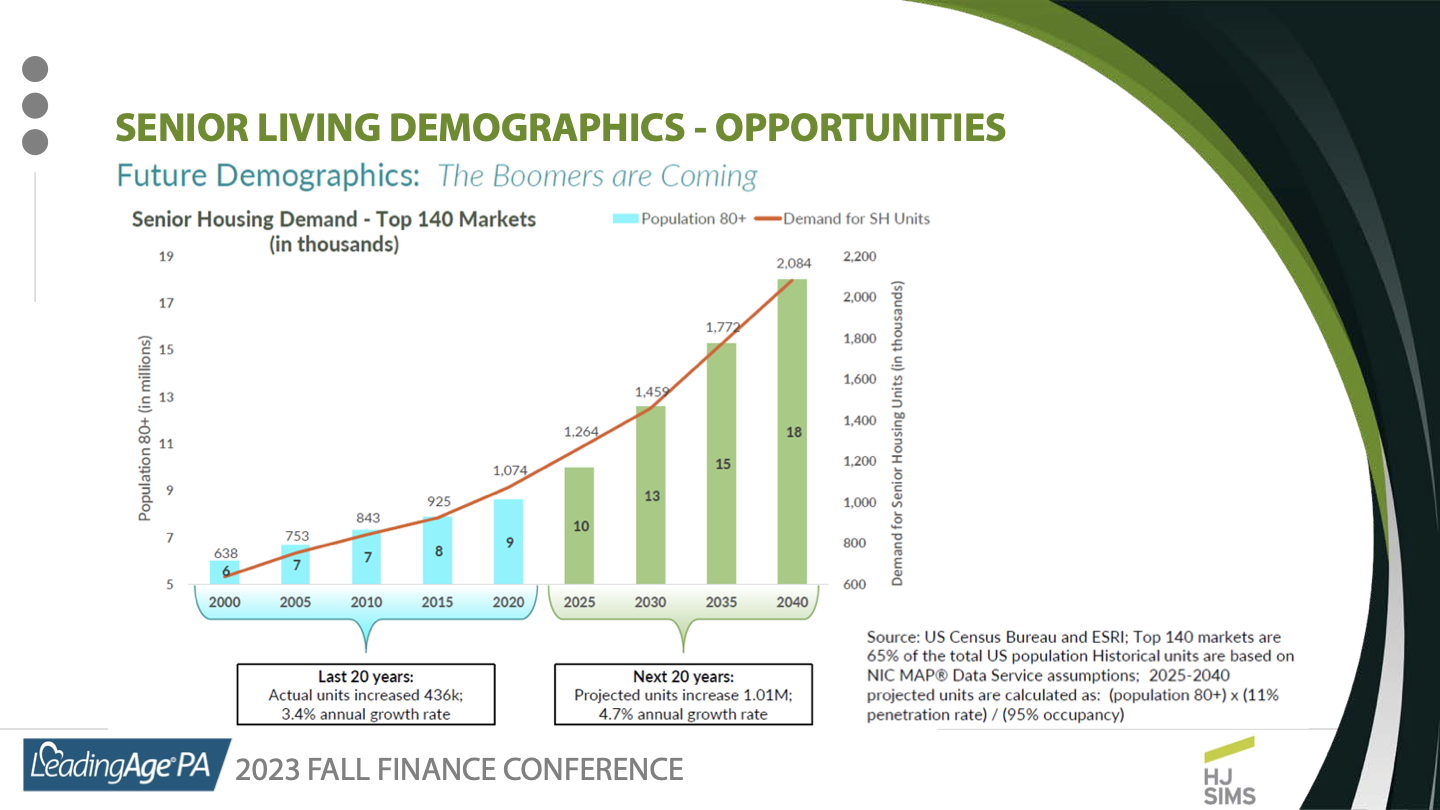

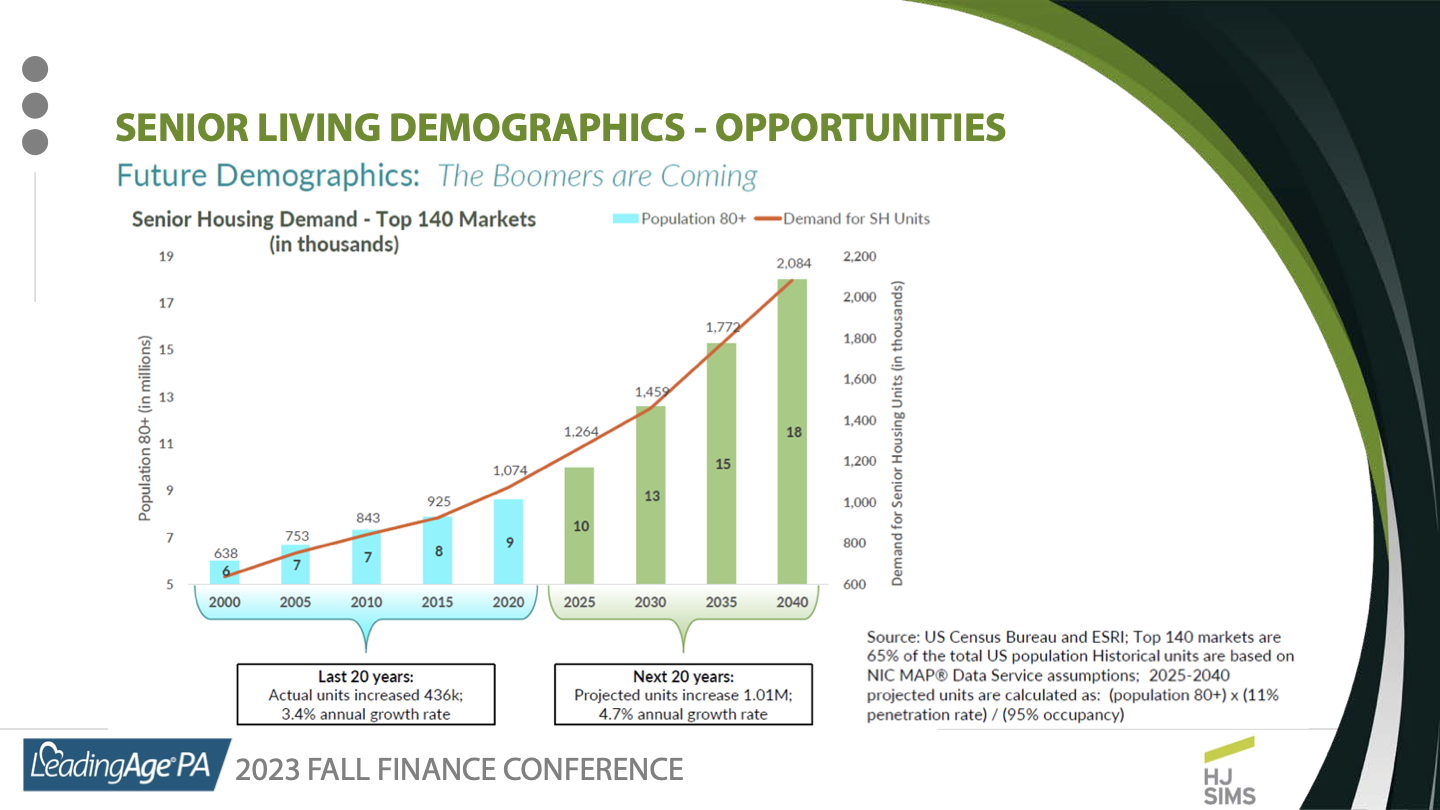

This statistic seems more real when you examine the demographic trends (Figure 1). Growth in the 65+ population, sometimes called the Silver Tsunami, is from the baby boomers aging in. It is encouraging to see providers like Lutheran Senior Services tuning their offering for the Silver Tsunami.

Figure 1. Demographic trends. Credit: Jim Bodine, HJ Sims, 2023 Leading Age PA Fall Finance Conference

Segmenting the aging-in-place population

Seniors, including those who want to age in place, can be segmented into low-acuity and high-acuity. The low-acuity and high-acuity segments often correlate with a life changing medical event that requires acute care involving admission to a hospital. After discharge from the hospital, the person receives post-acute care. In some cases during the post-acute care period, the person's health recovers and they return to being low-acuity. Alternatively, the person does not "fully recover." They are become high-acuity and require care. More specifically, the person requires long-term post-acute care (LTPAC).

The low-acuity and high-acuity stages map to how well the person is able to perform normal activities of daily living. High-acuity patients can be defined as persons that require assistance with one or more activities of daily living. Assistance can be from a family member or a paid caregiver.

Serving the aging in place population

Who serves the aging-in-place population? Combining the preference to age-in-place with a large and growing population of seniors it is not surprising that there are a growing set of technology and service providers that serve the aging-in-place market.

There is much greater coverage of high-acuity aging-in-place segment. This segment is served by Home Care and Home Health. Sometimes Home Care and Home Health are collectively called Home Health Care. For news coverage related to Home Health Care, see https://homehealthcarenews.com/.

The low-acuity aging-in-place segment is relatively underserved. In other words, this segment presents a lot of market opportunity.

The low-acuity aging-in-place segment is the "outpatient" analog of independent living segment at Life Plan Communities, also called Continuing Care Retirement Communities. Providers are not providing housing to this segment. Instead they are providing services. Specifically, they are providers of Providers of Home- and Community-Based Services (HCBS). Don't confuse the "Home" in HCBS with the "Home" in Home Health Care.

Why is Community thrown into HCBS? Seniors who are not socially isolated are part of a community. Seniors may consume services in a community setting. Thus Providers of HCBS serve seniors in their home and in community. A few examples of HCBS providers are:

- VigR Health. VigR Health is leveraging the success of Friends Life Care. They are exploring the association between aging-in-place and long term care insurance.

- Evergold. Evergold is leveraging their parent company's success in the reverse-mortgage space.

- Optage. Optage is Presbyterian Homes & Services' main HCBS program. It provides meals, home care, and hospice.

- Program of All-Inclusive Care for the Elderly (PACE). "PACE was created as a way to provide you, your family, caregivers, and professional health care providers the flexibility to meet your health care needs and to help you continue living in the community."

Please examine the links above to learn more about these program. Alternatively, talk to a consultant like Jordan River Living or Peak to Profit about HCBS.

To provide a continuum of care for the low-acute aging-in-place segment, there is the continuing care at home model, also called CCaH, @home, and CCRC without walls. CCaH merges the comfortable familiarity of staying in your existing home with the peace of mind, any necessary assistance, and healthcare-related services traditionally provided on-site by a continuing care retirement community (from here).

Currently, the services offered by many CCaH providers skew to the high-acuity senior. Many CCaHs core offering are caregivers---aides, nurses, physical therapists, etc. These CCaH's are more aligned with the Home Health Care segment discussed above.

How Wellzesta serves the aging-in-place providers

Wellzesta provides customizable engagement solutions for those who serve seniors.

Wellzesta Thrive is available for Home Health Care providers. Home Care agencies use Wellzesta Thrive to provide "care for the caregiver." Caregivers are the limiting resource for a Home Care organization. Wellzesta Thrive reduces caregiver turnover.

Wellzesta Life and Wellzesta Elevate are available to senior living providers. Wellzesta Elevate is for staff engagement. Wellzesta Life is for resident engagement. Wellzesta Life and Wellzesta Elevate utilize the same codebase. Features, wording, coloring, and other items are dynamically turned on/off (customized) according to the application (Life vs. Elevate) or the audience (resident vs. member).

The wizardry to dynamically turn on/off behavior within the App is called Feature Toggles , also called Feature Flags. Thanks to feature toggles, for aging-in-place:

- "Residents" become "members",

- Dining covers what can be delivered vs. what is available in the dining room,

- Most events become "virtual events",

- etc.